Monta Consulting & Design offers architectural product line development for large and small builders and developers. When developing a new product line, there are many factors MCD considers to ensure the result is what the builder envisions while achieving high marketability within the construction budget. Throughout the last year, there have been many shifts in market drivers. Below, we detail the changes and potential remedies that builders and developers should be aware of as they plan for new product lines to meet the relentless demand during the upcoming year.

Impacts on Demand

Population Growth

The demand for homebuyers in the last two years has surprised many analysts who suspected the pandemic would halt production; this holds true, especially in the Florida and Texas markets. At its foundation, the root of the demand is population growth. Although experts are concerned about the slowing population growth rate, the United States is still growing. In addition, life expectancy continues to increase, which also impacts consumer behavior. When you compound population growth and longevity with the unit shortage that has been accumulating since the 1960’s it is no mystery why we are experiencing the current level of demand.

Labor Shortages

Interestingly, with growing demand, there remains a labor shortage. The shortage is even more apparent in the construction industry and trades. In Florida, two of the top ten careers projected for growth into 2040 are industry-related and include civil engineering, construction management, and trades.

The shortage of the labor force will continue to be the root cause of slow home production in the United States. While many claim the COVID-19 pandemic has caused the imbalance, it merely expedited what was already in motion. The labor shortage is primarily due to baby boomers aging out of the workforce at a rapid pace. Younger generations succeeding them are slower to enter the workforce and are choosing different career paths. Before the pandemic, predictions already indicated that there would be a labor shortage as the baby boomers started to retire.

Material Shortages

At the beginning of 2022, it was predicted that material shortages would remain until 2023. Now it appears that deficits will remain for the foreseeable future and well into 2024. Globally, COVID-19 is still causing lockdowns in countries such as China that manufacture goods. In addition, the Russia and Ukraine war has stifled the production of many raw materials needed for manufacturing and construction. In Florida, Hurricane Ian will also result in further scarcity of materials over the next year. Although labor and material shortages can be considered hindrances, the combination is causing demand to increase, putting the industry even further behind.

The impact of population growth combined with labor and material shortages has only increased demand further. However, there are some factors, as detailed below, experts believe will curb demand. In the current market, these influences are preventing consumers from buying homes or changing their approach to buying a home. Trends that are decreasing demand due to consumer purchasing power are the rise in interest rates and the rapid increase in inflation.

Interest Rates

Feds have continued to raise interest rates to curb inflation. The target rate is projected to be up to 8% by the end of 2022. Current metrics indicate that the raise has only slightly impacted the real estate market; however, the actual impact is not usually evident until 18 months after the increase. The rise in rates has impacted entry-level buyers the most by preventing them from entering the market. Repeat buyers are now purchasing lower-priced homes due to the costs of financing.

Inflation

Every consumer has experienced rapid price increases from groceries to fuel due to scarcity that increased demand. The average inflation rate is typically 3% or lower. However, in the last 12 months, inflation has risen to 8.5% and peaked at 9.06% in June. It is projected by Kiplinger that inflation will not decrease until the beginning of 2024 by 3%-4%. The increased cost of essentials has substantially impacted the cost of living without an increase in income for many consumers. Above-average inflation will result in below-average consumer confidence and purchasing power.

Although experts are concerned about the changes in the finance industry slowing home building and the real estate market, some statistics can’t be ignored. The United States is over 3 million housing units short, and it would take over 20 years at typical production outputs to make up for the deficit with no population growth. There are also several geographic regions projected to experience rapid growth through 2040. History has proven the demand for housing doesn’t disappear but merely changes to meet market conditions and consumer behavior. Here are trends the MCD team expects to continue or increase for consideration when developing new product lines.

Demographic Preferences

Considering market impacts, consumer behavior and preferences are crucial when developing a new construction product line. Some statistics to consider are:

- The average home size is 1,900 square feet, with the Gen-X average being 2,400 square feet.

- Younger buyers (all but the baby boomers) are more likely to purchase a new home. Only about 40% of buyers who purchased existing inventory did so because it was their preference and not due to the price and availability of a new construction home.

- 36% of buyers who purchased were looking to avoid renovations

- Younger buyers are more considerate of environmental impact and utility and commute costs.

- Younger buyers are more educated on how to leverage real estate as investments making them more interested in returns on investment and products that will appreciate better.

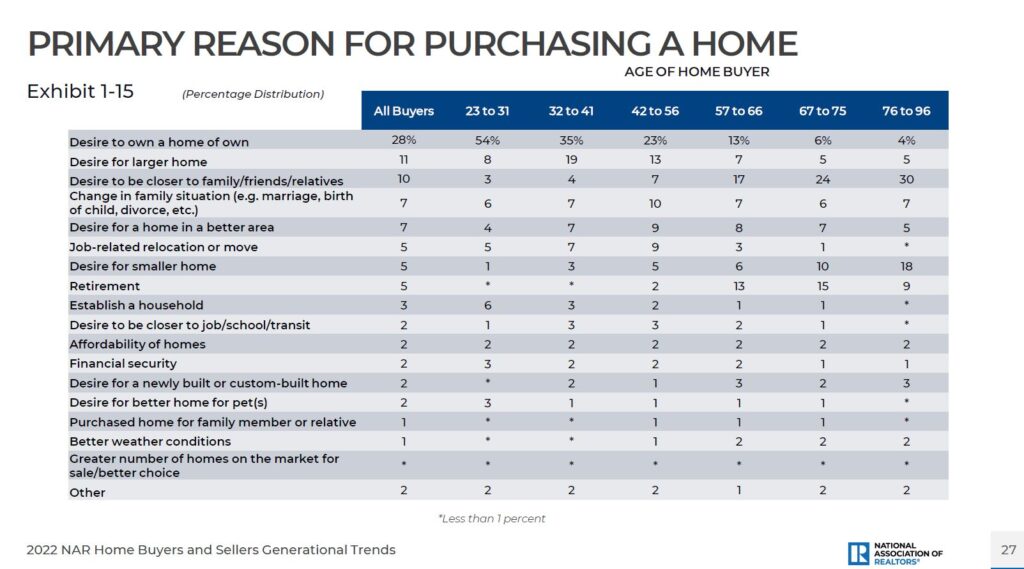

Baby Boomers are 58-76 years of age and make up the largest portion of home sellers. Interestingly, they move the longest distance to a retirement destination or closer to family and friends. Most people in this demographic are downsizing and seeking options with fewer maintenance requirements.

The Gen-X demographic, ages 42-57, has the highest income and share of married couples, hence dual incomes. They are likely purchasing their second or third home but are third behind millennials and boomers in purchase rate. In addition, they are the most diverse generation and more likely to buy a multi-generational home or relocate due to job opportunities in more desirable areas.

Millennials, ages 26-41, are the most significant portion of home buyers and makeup 70% of first-time home buyers. Millennials are the most formally educated generation and have the highest rate of unmarried couples purchasing homes together.

Gen Z consists of people ages 10-25 and is the smallest proportion of homebuyers at 2%. They are almost all first-time homebuyers and rate “financial security” as one of the top reasons for purchasing a home.

For more information on the primary reasons each generation is purchasing homes, review the National Association of Realtors chart below.

The Future of Home Design

Design trends that MCD currently implements or foresees trending in the future based on the information provided above are:

- Efficient floor plans with space to work from home

- Higher-quality construction & design

- More custom options

- Increased community amenities and access to services

- Increased technology integrated into the home

- Eco-Friendly design with proven costs reductions

- Pet-friendly features

- Multi-Generational floorplan options

- Bungalow, Craftsman, Cottage, Contemporary, & Colonial styles with a minimalist approach

- Fitness rooms

- Biophilic Design – bringing the outside in with connectivity to green spaces and increased natural light

These trends constantly evolve with consumer preferences and societal influences, but the MCD team is intentional about staying informed to produce the most competitive product lines for builders and developers.

Architectural Product Line Solutions

MCD’s proprietary approach offers many opportunities for cost savings and increased returns on investment throughout the entire product development process. The benefits that builders can expect from choosing our team for product development are as follows:

- Reduced time necessary for product development. When all stakeholders are present during the initial charrette, we can produce a new product line in as little as 2-3 weeks! The time could be further reduced when clients choose plans from our existing library.

- Reduced construction material costs. Integrated design and engineering services allow our team to value engineer plans for cost-effectiveness from the start.

- Reduced carrying costs are achieved by expediting the plan development process. When MCD provides services from design to permit, builders can also take advantage of expedited construction documents with a turnaround time of as little as three days. By combining every opportunity for efficiency, builders can reduce carrying time and costs by months.

To learn more about our product line development service, click here or schedule a consultation today and start working with a firm that prioritizes the best interest of its clients.